Low equity fees

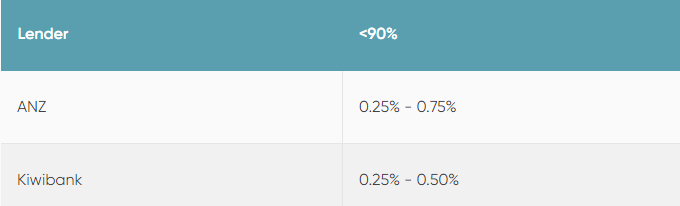

A low equity fee is a single charge that can be included in your mortgage, allowing you to avoid paying it upfront. The benefit of this fee is that you can pay it and then proceed without further obligations.

Low equity margin

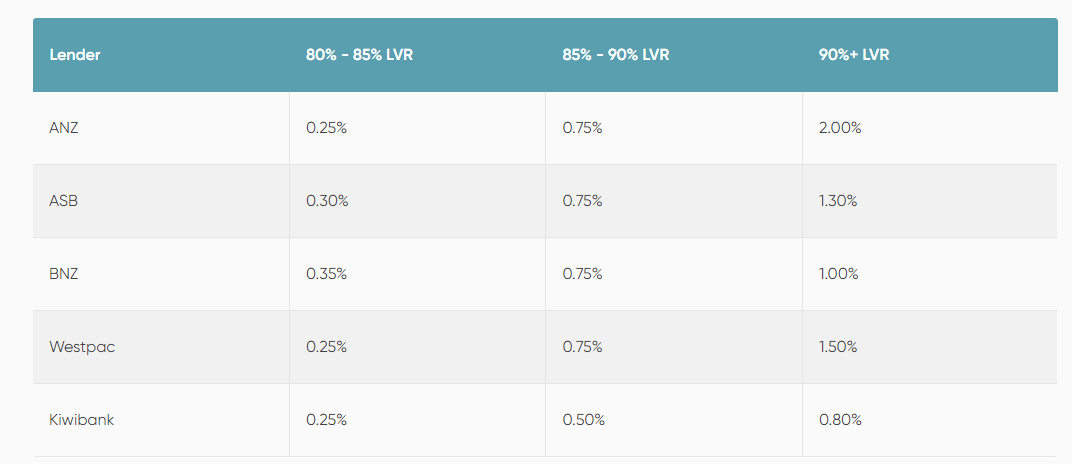

A low equity margin effectively translates to a higher interest rate on your mortgage, as banks perceive lending over 80% as a risk that they aim to mitigate by charging you more. Quite generous of them, right?

As your loan-to-value ratio (LVR) increases, so do the charges. Therefore, the quicker you can pay down the principal on your mortgage to build equity and lower your LVR, the sooner you can eliminate the margin. We often suggest making cost-effective renovations to enhance your property’s value.

Keep in mind that in most cases, you cannot remove the margin until your fixed-rate term ends. This means that even if your LVR falls below 80%, you won’t be able to eliminate the margin without breaking your loan, which might result in additional costs. The only exception is with BNZ, which allows for margin removal during a fixed term. Below is a list of the banks along with their respective margins.